Having "The Talk" with Parents

When is the right time to have “the talk” with your aging parents regarding their financial affairs and health care issues? In this now-common role reversal, adult children find that they must step up to “parent the parent.” This can be uncomfortable for everyone but is critically important for protecting assets and ensuring access to quality health care.

Download Free Tips

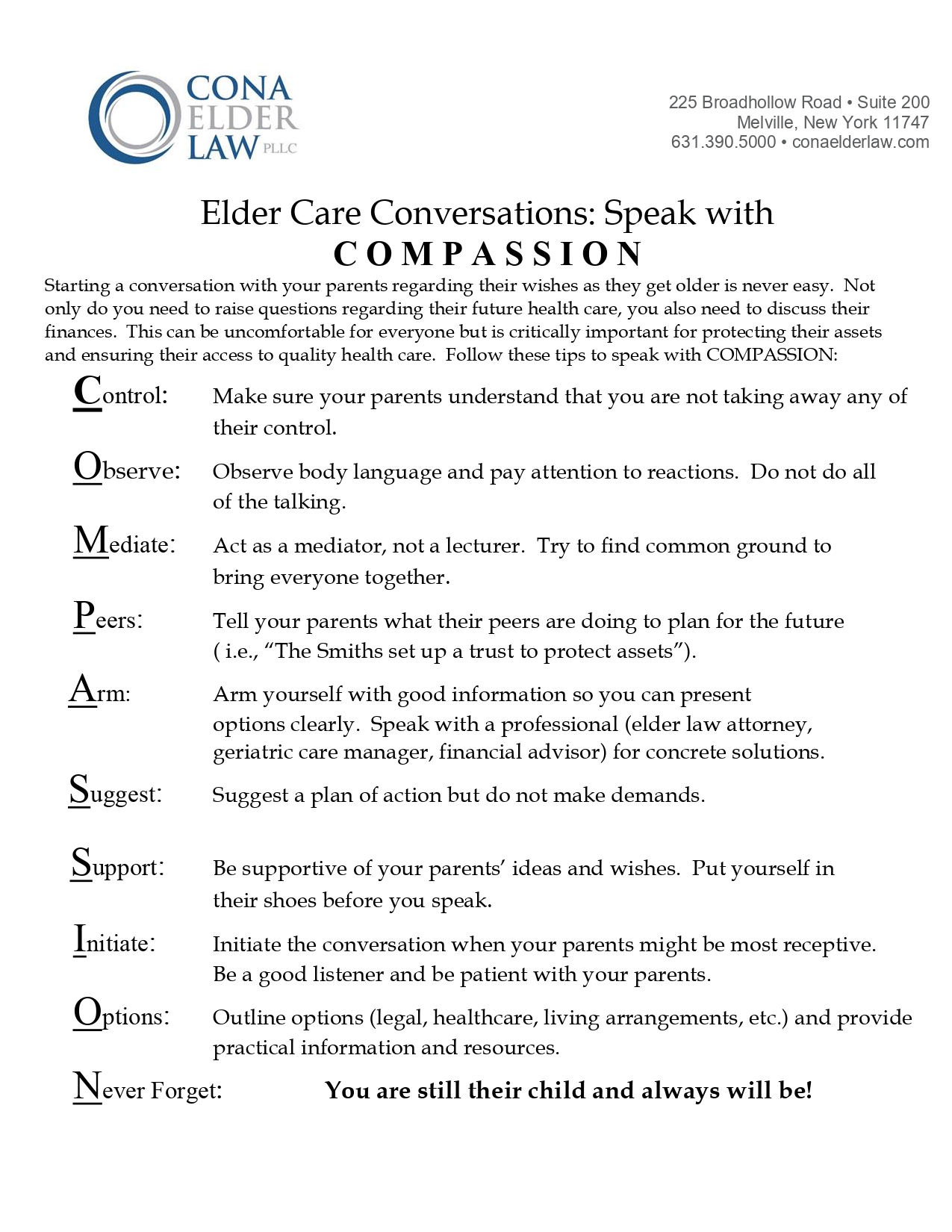

Elder Care Conversations: Speak with COMPASSION

Fill out the form to the right to receive a copy.

Elder Care Conversations:

Speak with Compassion

Use the tips in our free PDF to speak compassionately about elder care. Submit the form below and we'll email you the PDF:

It is critical for older adults to prepare and plan for their future care, including asset protection planning, designating decision-making proxies and advising family of their wishes as to health care treatments and even living arrangements. Such conversations must be had before a crisis occurs. Once these decisions are made, all family members will have peace of mind.

Your communication style will make a difference as to whether your loved ones will be receptive to delving into the subject. Remember to put yourself in their shoes and speak in a compassionate manner when asking questions and offering recommendations. Listen to their thoughts and feelings so you can respond appropriately. Let them know you are there to help them make the best decisions but not to take over control.

One tip: Start by telling your loved ones that you are putting your own financial affairs in order and explain what is involved and the documents needed. Then you can bridge to their situation and ask if they have done any planning for themselves. You can also give an example of a friend’s parents who planned in advance and highlight the positives, such as preservation of assets or seamless health care decision making.

Once you’ve opened up the conversation, remember to find out where your parents keep their financial records, tax returns, life insurance policies, wills, power of attorney, living will, health care proxy and other important papers.