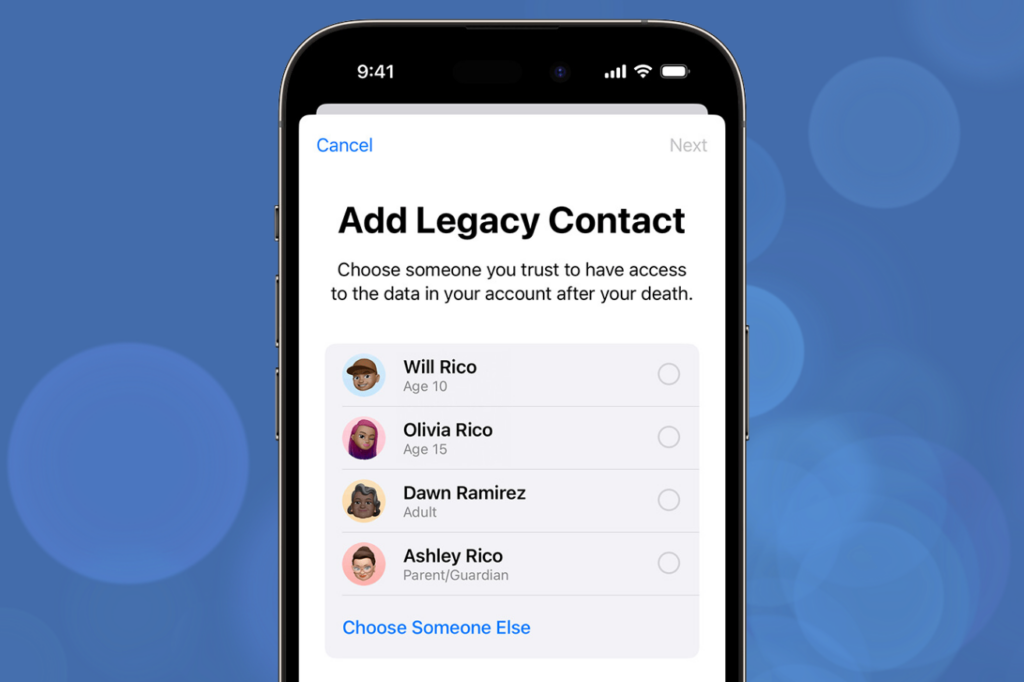

Understanding Legacy Contacts on Apple Devices: A Powerful Estate Planning Tool for Your Digital Assets

As technology continues to evolve, so do the ways we manage our digital lives. At Cona Elder Law, we believe in planning for every aspect of your future, including your […]

Continue reading

The Aging Prison Population: A Nursing Home Dilemma

In New York State and throughout the country, policymakers are struggling with the healthcare needs of a rapidly aging prison population. Prisons and jails have a constitutional obligation to provide […]

Continue reading

Jennifer Cona Breaks Down Elder Law as a Guest on the Donna Drake Show

Cona Elder Law Founder and Managing Partner Jennifer Cona describes counseling clients on the legal, financial and emotional issues involved in Elder Law planning. She provides tips for estate planning, […]

Continue reading

On-the-Ball Older Adults: How to Travel Smart This Summer

By Jennifer Cona, Esq. Originally published in the July 2024 issue of the Long Island Press, Power of Your Attorney. The economy is strong, inflation currently held at bay, and […]

Continue reading

How to Transfer Title to a Car After the Owner Passes Away

Most people pass away owning one or more cars in their name. Do you need to probate their Will to transfer the title to your name? Or to give the […]

Continue reading

Transfer on Death Deeds: To Deed or Not to Deed?

Effective July 20, 2024, Transfer on Death (TOD) deeds will be permitted in New York State. This will allow the transfer of a home to a named beneficiary(ies) without Probate […]

Continue reading

Medical Aid in Dying Act Gains Momentum But Legislature Fails to Act

Since 2016, the New York State legislature has been considering a measure known as the Medical Aid in Dying Act, which would allow terminally ill people to access life-ending medication. […]

Continue reading

Melissa Negrin-Wiener on the Radio Show Island Outlook with John Lynch

Connoisseur Media · Cona Elder Law June 2024 Recently, Melissa Negrin-Wiener was on the radio show Island Outlook with John Lynch. Click here to listen to the radio show. Date: […]

Continue reading

Melissa Negrin-Weiner on Things You Should Leave Out of Your Will

Melissa Negrin-Weiner’s insights were recently featured in a Kiplinger article titled “Seven Things You Should Leave Out of Your Will, According to Experts”. To read the full article click here. […]

Continue reading

Are You Avoiding Estate Planning? Procrastinate No More!

By Jennifer Cona, Esq. Originally published in the June 2024 issue of the Long Island Press, Power of Your Attorney. If you have an Estate Plan, congratulations! You are one […]

Continue reading