Category Archives for Estate Planning (Wills and Trusts), Probate/Estate Administration

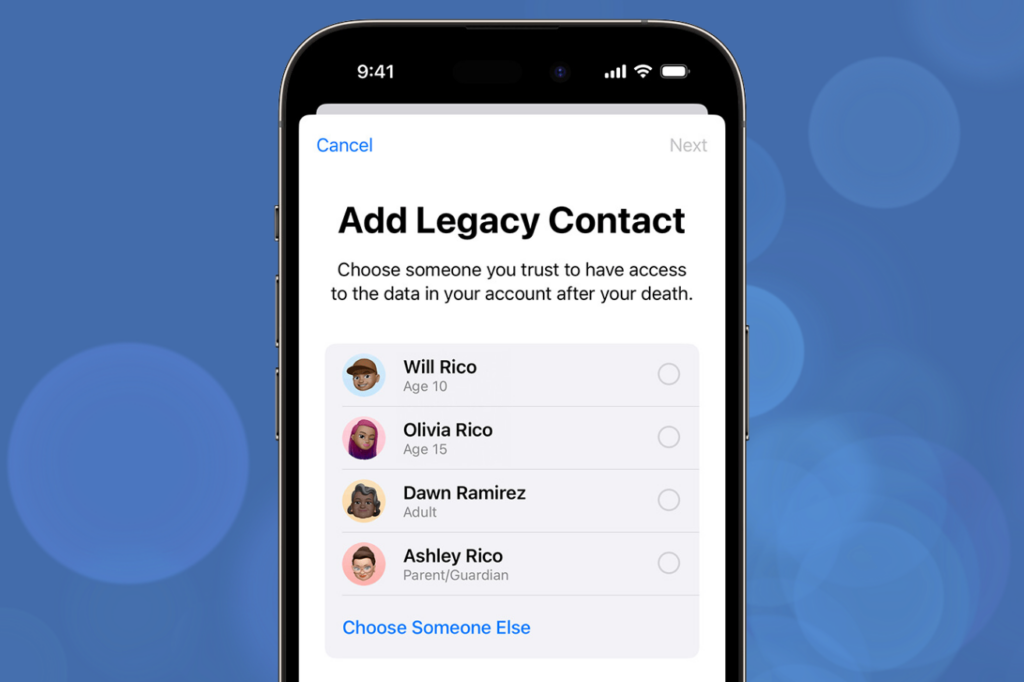

Understanding Legacy Contacts on Apple Devices: A Powerful Estate Planning Tool for Your Digital Assets

As technology continues to evolve, so do the ways we manage our digital lives. At Cona Elder Law, we believe in planning for every aspect of your future, including your […]

Continue reading

How to Transfer Title to a Car After the Owner Passes Away

Most people pass away owning one or more cars in their name. Do you need to probate their Will to transfer the title to your name? Or to give the […]

Continue reading

Transfer on Death Deeds: To Deed or Not to Deed?

Effective July 20, 2024, Transfer on Death (TOD) deeds will be permitted in New York State. This will allow the transfer of a home to a named beneficiary(ies) without Probate […]

Continue reading

IRS Stands Down (Temporarily) on Inherited IRA Required Minimum Distribution (RMD) Rules

The IRS has announced that a 25% excise tax will not be imposed against individuals who in 2024 failed to abide by the SECURE Act’s new RMD requirements for inherited […]

Continue reading

Providing For Your Child with Special Needs Beyond Your Lifetime

If your child has special needs, they likely depend on you tremendously for support. Have you considered how to provide for your child with special needs when the time comes […]

Continue reading

Melissa Negrin-Weiner on When, Why and How To Make Someone Your Power of Attorney

Melissa Negrin-Weiner’s insights were recently featured in a GoBankingRates article titled “When, Why, and How To Make Someone Your Power of Attorney”. To read the full article click here. A […]

Continue reading

Check Your Trust: Are Your Assets Protected?

By Jennifer Cona, Esq. Originally published in the April 2024 issue of the Long Island Press, Power of Your Attorney. There are many kinds of trusts, each with a different […]

Continue reading

TAWC: Tools and Advice for Working Caregivers

In honor of Women’s History Month, let’s examine the role of women as elder caregivers, and particularly working women who shoulder the bulk of this unpaid care. The average elder […]

Continue reading

What is a Guardianship?

By Jennifer Cona, Esq. Originally published in the Long Island Press, Power of Your Attorney. Caring for a loved one as they get older is often very difficult. When that […]

Continue reading

Medicare vs. Medicaid: What Are the Differences?

By Jennifer Cona, Esq. Originally published in the February issue of Long Island Press, Power of Your Attorney. By now, you should have enrolled or re-enrolled in a Medicare Plan […]

Continue reading