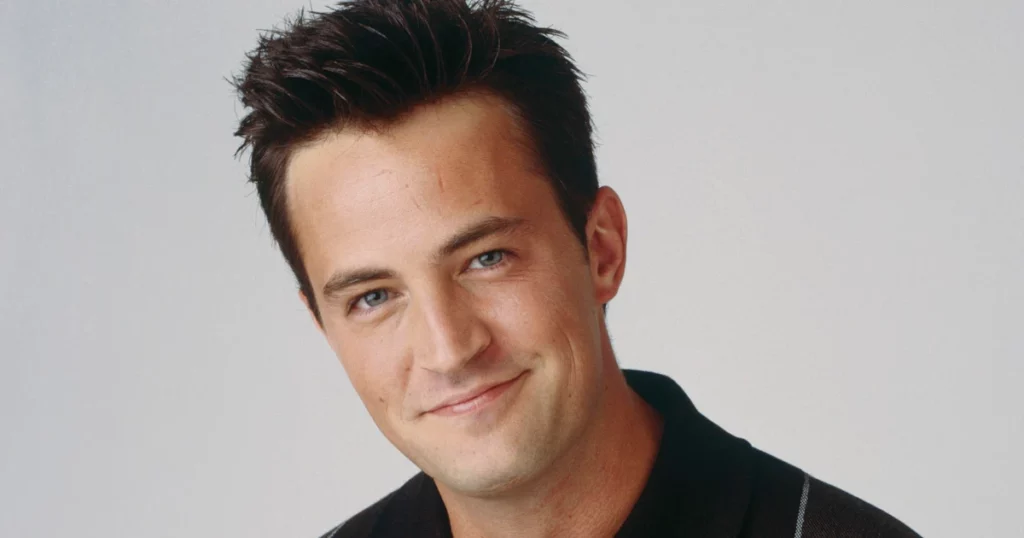

Untimely Death of Matthew Perry Highlights Need to Plan For Residuals and Royalties

With the passing of Matthew Perry, we lost another beloved celebrity in 2023. Celebrity deaths, like their lives, hold the public captive, desperate to understand the talent that was lost. In the coming weeks and months, we will undoubtably learn of how Matthew Perry died, how he chose to take care of his loved ones upon his death and what he did, independently from the Matthew Perry Foundation, which was launched in his honor, to help those struggling with the disease of addiction. And during this time, the residuals from his acting career will continue to be paid.

What are Residuals?

Residuals are income earned by a writer, actor, singer or other artist when their work gets reused. Residuals are a result of a service rendered – acting in a television show or their music being played, for example. Royalties are paid for content created, such as music or literature. Royalties can also be earned from a patent, brand licensing, franchise or certain licensing rights. And while some payments from residuals or royalties will either decrease over time or be limited in time frame, others may be indefinite.

What Happens to a Creator’s Residuals After They Pass?

When creators die, the residuals and royalties they earned during their life may continue. This is why, as with any asset, it is important your estate plan carefully considers and addresses this asset as well as the planning opportunities it affords. Key questions before one ultimately designates a beneficiary or beneficiaries is to understand the earning potential of the residual or royalties, the estimated worth of this asset and how long the asset’s worth will be maintained (again, some residuals or royalties may fade over time and some may last indefinitely).

Once the value and regularity of the payments from one’s residuals or royalties is fully captured, it is possible to understand what planning opportunities are available and how best to maximize one’s legacy. This can be either through a specific bequest to one or more beneficiaries, an irrevocable trust which can allow the legacy to grow and benefit more individuals and possibly charities while maintaining control over future generations, or through charitable giving which can carry a legacy far beyond one’s life.

Consult a Long Island Estate Planning Attorney Today

Understanding your assets, your goals, and your planning opportunities is not one size fits all. Speak with the experienced and compassionate trust and estate attorneys at Cona Elder Law to be sure you get the best legal advice tailored to your needs. Contact us at 631.390.5000 or elder@conalaw.com.

About the Author Cona Elder Law

Related Posts

Out Front: Election Insights: Candidates’ Plans for Elder Care

Online Will Programs: You Get What You Pay For

Advice for Snowbirds and Those with Out-of-State Wills

Grandparents and Grandchildren: What Are Your Rights?

Grandparents Do Have Rights

The Real Cost of Probate